UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under §240.14a-12

| Crown Crafts, Inc. |

| (Name of Registrant as Specified in Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

June 30, 2021

Dear Stockholders:

It is my pleasure to invite you to this year’s Annual Meeting of Stockholders, which will be held on Tuesday, August 10, 2021, at 10:00 a.m., local time, at our offices located at 916 South Burnside Avenue, Third Floor, Gonzales, Louisiana.

Details regarding the Annual Meeting and the business to be conducted are described in the Notice of Internet Availability of Proxy Materials you received in the mail and in the accompanying proxy statement. We have also made available a copy of our 2021 Annual Report to Stockholders with this proxy statement. We encourage you to read these materials, which include our audited financial statements and provide information about our business.

We have elected to provide access to our proxy materials over the Internet in accordance with the U.S. Securities and Exchange Commission’s “notice and access” rules. Accordingly, most stockholders will not receive paper copies of our proxy materials. The Notice of Internet Availability of Proxy Materials provides information on how stockholders may obtain paper copies of our proxy materials if they so choose.

Whether or not you plan to attend the Annual Meeting, please vote as soon as possible to ensure that your shares will be represented and voted at the Annual Meeting. You may vote over the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing the completed proxy card. If you attend the Annual Meeting, then you may vote your shares in person even though you have previously voted your proxy.

Thank you for your ongoing support of, and continued interest in, Crown Crafts.

| Sincerely, | |

|

|

|

E. Randall Chestnut Chairman and Chief Executive Officer |

|

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS |

The 2021 Annual Meeting of Stockholders of Crown Crafts, Inc. will be held at our executive offices, located at 916 South Burnside Avenue, Third Floor, Gonzales, Louisiana, on August 10, 2021, at 10:00 a.m., Central Daylight Time, for the following purposes:

|

(i) |

To elect two Class II directors to our Board of Directors to serve until the Company’s annual meeting of stockholders to be held in 2024 and until their successors are elected and qualified or until their earlier death, resignation or removal from office; |

|

(ii) |

To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 3, 2022; |

|

(iii) |

To approve, on an advisory basis, the compensation of the Company’s named executive officers; |

|

(iv) |

To approve the Crown Crafts, Inc. 2021 Incentive Plan; and |

|

(v) |

To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Our Board of Directors has fixed June 11, 2021 as the record date to determine the stockholders entitled to notice of and to vote at the Annual Meeting. Only those stockholders of record of Crown Crafts Series A common stock as of the close of business on that date will be entitled to vote at the Annual Meeting or at any adjournment or postponement thereof.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the accompanying proxy statement and submit your proxy as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section of the accompanying proxy statement titled “Proxy Solicitation and Voting Information” or, if you requested to receive printed proxy materials, the included proxy card. To obtain directions to attend the Annual Meeting and vote in person, please contact our Corporate Secretary at (225) 647-9100.

| June 30, 2021 | By Order of the Board of Directors, |

|

|

| Craig J. Demarest | |

| Vice President, Chief Financial Officer and Corporate Secretary |

|

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

The proxy statement and our 2021 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended March 28, 2021, are available free of charge at https://materials.proxyvote.com/228309. |

|

TABLE OF CONTENTS |

916 South Burnside Avenue

Gonzales, Louisiana 70737

PROXY STATEMENT

FOR

2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 10, 2021

Why am I receiving these proxy materials?

The Board of Directors (the “Board”) of Crown Crafts, Inc. (“Crown Crafts”, the “Company”, or “we”) has made these proxy materials available to you on the Internet or, upon your request, has delivered printed versions of these proxy materials to you by mail, in connection with the solicitation of proxies by and on behalf of the Board for use at the Company’s 2021 Annual Meeting of Stockholders to be held at the Company’s executive offices, located at 916 South Burnside Avenue, Third Floor, Gonzales, Louisiana, on August 10, 2021, at 10:00 a.m., Central Daylight Time (the “Annual Meeting”), and any adjournment or postponement thereof. Stockholders of the Company are invited to attend the Annual Meeting and are requested to vote on the proposals described in this proxy statement for the Annual Meeting (this “Proxy Statement”).

These proxy materials were first made available to stockholders on or about June 30, 2021.

What is included in these materials?

These materials include:

|

• |

This Proxy Statement; and |

|

• |

The Company’s 2021 Annual Report to Stockholders (the “2021 Annual Report”), which includes the Company’s Annual Report on Form 10-K for the fiscal year ended March 28, 2021 (the “fiscal year 2021”). |

If you request printed versions of these proxy materials by mail, then they will also include the proxy card for the Annual Meeting.

Why did I receive a one-page notice in the mail or email notification regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), the Company has provided access to its proxy materials over the Internet. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice, free of charge, or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy of the proxy materials may be found in the Notice. In addition, stockholders may request to receive proxy materials electronically by email on an ongoing basis.

How can I get electronic access to the proxy materials?

The Notice provides you with instructions regarding how to:

| • | View proxy materials for the Annual Meeting on the Internet and execute a proxy; and | |

|

• |

Instruct the Company to send future proxy materials to you electronically by email. |

Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you and will reduce the impact of the Annual Meetings on the environment. If you choose to receive future proxy materials by email, then you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

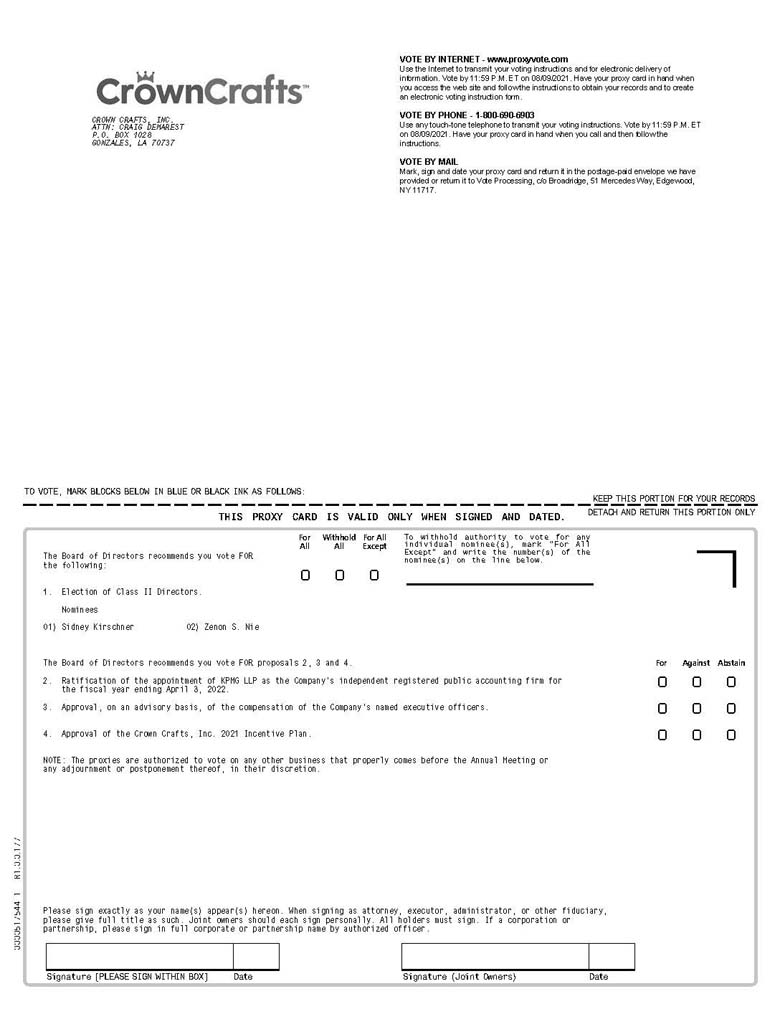

What is being voted on at the Annual Meeting?

Stockholders are being asked to vote on the following proposals, which are more fully described in this Proxy Statement:

| • | To elect two Class II directors to the Board to serve until the Company’s annual meeting of stockholders to be held in 2024 and until their successors are elected and qualified or until their earlier death, resignation or removal from office (“Proposal 1”); | |

|

• |

To ratify the appointment of KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm for the fiscal year ending April 3, 2022 (“Proposal 2”); |

|

• |

To approve, on an advisory basis, the compensation of the Company’s named executive officers (“Proposal 3”); and |

|

• |

To approve the Crown Crafts, Inc. 2021 Incentive Plan (the “2021 Plan”) (“Proposal 4”). |

In addition to the above matters, we will transact any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. As of the date of this Proxy Statement, the Board knows of no other matters that will be brought before the Annual Meeting. However, if other matters are properly presented at the Annual Meeting or any adjournment or postponement of the Annual Meeting, then the persons named as proxies will vote in their discretion with respect to those matters.

Who can vote at the Annual Meeting?

You may vote if you are a stockholder of record of the Company’s Series A common stock, par value $0.01 per share (the “Common Stock”), as of the close of business on June 11, 2021, the record date for the Annual Meeting (the “Record Date”). As of the Record Date, there were 10,023,307 shares of Common Stock outstanding and entitled to vote at the Annual Meeting, held by 152 holders of record. A list of the Company’s stockholders will be available for review at the Company’s executive offices during regular business hours for a period of ten days before the Annual Meeting.

If you are a beneficial owner of the Common Stock as of the close of business on the Record Date, then you will receive voting instructions from the brokerage firm, bank or other nominee that holds your shares as the holder of record. You must follow the voting instructions of the holder of record in order for your shares to be voted.

As of the Record Date, the Company’s directors and executive officers as a group beneficially owned, and were entitled to vote, 1,164,292 shares of Common Stock, or approximately 11.62% of the outstanding shares of Common Stock on that date.

How many votes am I entitled to cast?

Each holder of record of the Common Stock is entitled to one vote for each share of Common Stock held by such holder on the Record Date. Cumulative voting is not permitted, and stockholders are not entitled to appraisal or dissenters’ rights with respect to any matter to be voted on at the Annual Meeting.

Your shares can be voted at the Annual Meeting only if you are present or represented by a valid proxy.

How does the Board recommend I vote?

The Board has unanimously determined to recommend that stockholders vote:

|

• |

“FOR” the Class II director nominees; |

|

• |

“FOR” the ratification of the appointment of KPMG as the Company’s independent registered public accounting firm for the fiscal year ending April 3, 2022; |

|

• |

“FOR” the approval, on an advisory basis, of the compensation of the Company’s named executive officers; and |

|

• |

“FOR” the approval of the 2021 Plan. |

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most of our stockholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record. If, on the Record Date, your shares were registered directly in your name with our transfer agent, Broadridge Corporate Issuer Solutions, Inc. (“Broadridge”), then you are a “stockholder of record” who may vote at the Annual Meeting, and we are providing these proxy materials directly to you.

Beneficial Owner. If, on the Record Date, your shares were held in an account at a brokerage firm or at a bank or other nominee holder, then you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your brokerage firm, bank or other nominee holder who is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your brokerage firm, bank or other nominee holder how to vote your shares and to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from your brokerage firm, bank or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank or other nominee holder. Obtaining a valid proxy may take several days.

How do I vote my shares?

If you are a stockholder of record, then you may vote using one of the following four methods:

|

• |

Over the Internet, which you are encouraged to do if you have access to the Internet; |

|

• |

By telephone; |

|

• |

By completing, signing and returning the included proxy card, for those who requested to receive printed proxy materials in the mail; or |

|

• |

By attending the Annual Meeting and voting in person. |

The Notice provides instructions on how to access your proxy, which contains instructions on how to vote via the Internet or by telephone. For stockholders who request to receive a paper proxy card in the mail, instructions for voting via the Internet, by telephone or by mail are set forth on the proxy card.

If you hold your shares in street name, then your brokerage firm, bank or other nominee who holds your shares is considered the stockholder of record for purposes of voting at the Annual Meeting. The stockholder of record will provide you with instructions on how to vote your shares. Internet and telephone voting will be offered to stockholders owning shares through most brokerage firms and banks. Additionally, if you would like to vote in person at the Annual Meeting, then you must contact the brokerage firm, bank or other nominee who holds your shares to obtain a valid proxy from them and bring it with you to the Annual Meeting. You will not be able to vote at the Annual Meeting unless you have a valid proxy from your brokerage firm, bank or other nominee holder.

Can I change my mind after I vote?

If you are a stockholder of record and vote by proxy, then you may revoke that proxy at any time before it is voted at the Annual Meeting. You may do this by using one of the following methods:

|

• |

Voting again by telephone or over the Internet until 11:59 p.m., Eastern Daylight Time, on August 9, 2021; |

|

• |

Giving written notice to the Company’s Corporate Secretary at Crown Crafts, Inc., P.O. Box 1028, Gonzales, Louisiana 70707, Attn.: Corporate Secretary; |

|

• |

Delivering a later-dated proxy; or |

|

• |

Voting in person at the Annual Meeting. |

If you hold your shares in street name, then you may change your vote by submitting new voting instructions to your brokerage firm, bank or other nominee holder. You must contact your broker, bank or other nominee holder to find out how to do so. However, since you are not the stockholder of record in that case, you may not change your vote by voting those shares in person at the Annual Meeting unless you receive a valid proxy from your brokerage firm, bank or other nominee holder authorizing you to vote at the Annual Meeting.

How many votes must be present to hold the Annual Meeting?

In order for the Company to conduct the Annual Meeting, the holders of a majority of the shares of Common Stock issued and outstanding and entitled to vote must be present, in person or by proxy, at the Annual Meeting. This is referred to as a quorum. Your shares will be counted as present at the Annual Meeting if you do one of the following:

|

• |

Vote via the Internet or by telephone; |

|

• |

Return a properly executed proxy by mail; or |

|

• |

Attend the Annual Meeting and vote in person. |

Shares represented by valid proxies received but marked as abstentions, and shares represented by valid proxies received but reflecting broker non‑votes, will be counted as present at the Annual Meeting for purposes of establishing a quorum.

If a quorum is not present at the Annual Meeting, then it is expected that the Annual Meeting will be adjourned or postponed to solicit additional proxies.

What are broker non‑votes?

Under certain circumstances, including the election of directors, matters involving executive compensation and other matters considered non-routine, brokerage firms and banks are prohibited from exercising discretionary authority for beneficial owners who have not provided voting instructions to the brokerage firm or broker. This is generally referred to as a “broker non-vote.” In these cases, as long as a routine matter is also being voted on, and in cases where the stockholder does not vote on such routine matter, those shares will be counted for the purpose of determining if a quorum is present, but will not be included as votes cast with respect to those matters. Whether a brokerage or bank has authority to vote its shares on uninstructed matters is determined by stock exchange rules. We expect that brokerage firms and brokers will be allowed to exercise discretionary authority for beneficial owners who have not provided voting instructions only with respect to Proposal 2 but not with respect to any of the other proposals to be voted on at the Annual Meeting.

What vote is required, and how will the votes be counted, to elect directors and to adopt each of the other proposals?

The following chart describes the proposals to be considered at the Annual Meeting, the vote required to elect directors and to adopt each of the other proposals, and the manner in which votes will be counted:

|

Proposal |

Voting |

Vote Required to Adopt Proposal |

Effect of Abstentions |

Effect of Broker Non-Votes |

|

Election of Class II Directors (Proposal 1) |

For or Withhold |

A nominee will be elected by a plurality of votes cast at the Annual Meeting, meaning that the two Class II nominees receiving the most votes will be elected as the Class II directors |

No effect |

No effect |

|

Ratification of KPMG (Proposal 2) |

For, Against or Abstain |

The affirmative vote of a majority of the votes cast at the Annual Meeting |

No effect |

Brokers have discretion to vote |

|

Approval, on an Advisory Basis, of the Compensation of the Company’s Named Executive Officers (Proposal 3) |

For, Against or Abstain |

The affirmative vote of a majority of the votes cast at the Annual Meeting |

No effect |

No effect |

|

Approval of the 2021 Plan (Proposal 4) |

For, Against or Abstain |

The affirmative vote of a majority of the votes cast at the Annual Meeting |

No effect |

No effect |

We are asking our stockholders to approve the 2021 Plan at the Annual Meeting, among other reasons, because the rules of The Nasdaq Stock Market (“Nasdaq”) require stockholder approval of equity compensation arrangements pursuant to which stock may be acquired by officers, directors, employees or consultants. Under the Nasdaq rules, stockholder approval of the 2021 Plan requires approval by a majority of votes cast and abstentions will have no effect.

How many votes are needed for other matters that may be brought before the Annual Meeting?

In the event that any other matter is properly brought before the Annual Meeting, the affirmative vote of a majority of the votes cast in respect of such matter will be required for its approval. The Board knows of no other matters that will be brought before the Annual Meeting. If other matters are properly introduced, then the persons named in the proxy as the proxy holders will vote on such matters in their discretion.

Will my shares be voted if I do not provide my proxy?

If you are a stockholder of record, then your shares will not be voted if you do not vote them or provide a proxy.

If you hold your shares in in street name and if your brokerage firm or bank signs and returns a proxy on your behalf that does not contain voting instructions, then your shares will count as present at the Annual Meeting for quorum purposes, but your shares will not count as a vote cast in respect of any proposal.

What if my shares are registered in more than one person’s name?

If you own shares that are registered in the name of more than one person, then each person must sign the proxy. If an attorney, executor, administrator, trustee, guardian or any other person signs the proxy in a representative capacity, then the full title of the person signing the proxy should be given and a certificate should be furnished showing evidence of appointment.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, then you have multiple accounts with brokers or Broadridge, the Company’s transfer agent. Please vote all of these shares. It is recommended that you contact your broker or Broadridge, as applicable, to consolidate as many accounts as possible under the same name and address. Broadridge may be contacted by telephone at (877) 830-4936.

How are proxies solicited and what is the cost?

The Company will bear all costs incurred on behalf of the Board in connection with its solicitation of proxies from the holders of Common Stock for the Annual Meeting, including any costs associated with printing and mailing proxy materials for those stockholders who request to receive printed versions of them.

In addition, directors, officers and employees of the Company and its subsidiaries may solicit proxies by mail, personal interview, telephone, email or facsimile transmission without additional compensation. The Company may also solicit proxies through press releases and postings on its website at www.crowncrafts.com. Arrangements will be made with brokerage houses, voting trustees, banks, associations and other custodians, nominees and fiduciaries, who are record holders of Common Stock not beneficially owned by them, for forwarding these proxy materials to, and obtaining proxies from, the beneficial owners of such stock entitled to vote at the Annual Meeting. The Company will reimburse these persons for their reasonable expenses incurred in doing so.

How will votes be counted?

All votes will be tabulated by the inspector of elections for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Where do I find the voting results for the Annual Meeting?

The Company will announce preliminary voting results at the Annual Meeting. The final voting results will be tallied by the inspector of elections at the Annual Meeting and subsequently published in the Company’s Current Report on Form 8-K, which the Company is required to file with the SEC within four business days following the Annual Meeting.

Who can help answer my questions?

You can contact our Corporate Secretary, Craig J. Demarest, by telephone at (225) 647-9100 or by writing to Crown Crafts, Inc., P.O. Box 1028, Gonzales, Louisiana 70707, Attn.: Corporate Secretary, with any questions about the proposals described in this Proxy Statement or how to execute your vote.

The Board is committed to maintaining sound and effective corporate governance principles and believes that strong corporate governance is critical to achieving our performance goals and to maintaining the trust and confidence of stockholders, employees, suppliers, customers and regulatory agencies. The Board regularly reviews the Company’s corporate governance practices in light of proposed and adopted laws and regulations, the practices of other leading companies, the recommendations of various corporate governance authorities and the expectations of our stockholders.

The Board is responsible for establishing broad corporate policies of the Company, monitoring the Company’s overall performance and ensuring that the Company’s activities are conducted in a responsible and ethical manner. However, in accordance with well-established corporate legal principles, the Board is not involved in the Company’s day-to-day operating matters. Members of the Board are kept informed about the Company’s business by participating in Board and committee meetings, by reviewing analyses and reports provided to them by the Company and through discussions with the Chairman of the Board, the Lead Director and officers of the Company.

Each non-employee member of the board is “independent,” as defined for purposes of the rules of the SEC, the listing standards of the Nasdaq and Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). For a director to be considered independent, the Board must determine that the director does not have a relationship with the Company that would interfere with the exercise of his or her independent judgment in carrying out his or her responsibilities of a director. In making this determination, the Board considers all relevant facts and circumstances, including any transactions or relationships between the director and the Company or its subsidiaries.

Code of Business Conduct and Ethics; Code of Conduct for Directors

The Company has adopted a Code of Business Conduct and Ethics that is applicable to all directors and employees, including the Company’s Chief Executive Officer and Chief Financial Officer. The Code of Business Conduct and Ethics covers topics such as conflicts of interest, insider trading, competition and fair dealing, discrimination and harassment, health and safety, confidentiality, payments to governmental personnel and compliance procedures. The Code of Business Conduct and Ethics is posted on the Company’s website at www.crowncrafts.com. In addition, the Company has also adopted a Code of Conduct for Directors, which is also posted on the Company’s website at www.crowncrafts.com.

During fiscal year 2021, the Board had the following standing committees: Audit Committee, Compensation Committee, Nominating and Governance Committee, and Capital Committee. The responsibilities assigned by the Board to each of these committees are briefly described below.

Audit Committee. The Audit Committee is currently comprised of three members, none of whom is a current or former employee of the Company or any of its subsidiaries and all of whom are, in the opinion of the Board, free from any relationship that would interfere with the exercise of their independent judgment in the discharge of the Audit Committee’s duties. See “Report of the Audit Committee.” The current members of the Audit Committee are Donald Ratajczak (Chair), Sidney Kirschner and Patricia Stensrud. The Audit Committee has adopted a formal, written charter, which has been approved by the full Board and which specifies the scope of the Audit Committee’s responsibilities and how it should carry them out. The complete text of the Audit Committee charter is available on the Company’s website at www.crowncrafts.com.

The Audit Committee represents the Board in discharging its responsibility relating to the accounting, reporting and financial practices of the Company and its subsidiaries. Its primary functions include monitoring the integrity of the Company’s financial statements and system of internal controls and the Company’s compliance with regulatory and legal requirements; monitoring the independence, qualifications and performance of the Company’s independent auditor; and providing a line of communication among the independent auditor, management and the Board.

Compensation Committee. The Compensation Committee is currently comprised of three directors, Zenon S. Nie (Chair), Sidney Kirschner and Patricia Stensrud, none of whom is a current or former employee of the Company or any of its subsidiaries and all of whom are, in the opinion of the Board, free from any relationship that would interfere with the exercise of their independent judgment in the discharge of the Compensation Committee’s duties. The Compensation Committee has adopted a formal, written charter, which has been approved by the full Board and which specifies the scope of the Compensation Committee’s responsibilities and how it should carry them out. The complete text of the Compensation Committee charter is available on the Company’s website at www.crowncrafts.com.

The duties of the Compensation Committee are generally to establish the compensation for the Company’s executive officers and to act on such other matters relating to compensation as it deems appropriate, including an annual evaluation of the Company’s Chief Executive Officer and the design and oversight of all compensation and benefit programs in which the Company’s employees and officers are eligible to participate.

Nominating and Governance Committee. The Nominating and Governance Committee is currently comprised of three directors, Zenon S. Nie (Chair), Sidney Kirschner and Donald Ratajczak, none of whom is a current or former employee of the Company or any of its subsidiaries and all of whom are, in the opinion of the Board, free from any relationship that would interfere with the exercise of their independent judgment in the discharge of the Nominating and Governance Committee’s duties. The Nominating and Governance Committee has adopted a formal, written charter, which has been approved by the full Board and which specifies the scope of the Nominating and Governance Committee’s responsibilities and how it should carry them out. The complete text of the Nominating and Governance Committee charter is available on the Company’s website at www.crowncrafts.com.

The Nominating and Governance Committee has the general responsibility for overseeing the Company’s corporate governance practices and for identifying, reviewing and recommending to the Board individuals to be nominated for election to the Board. The Nominating and Governance Committee will also consider any director candidate proposed in good faith by a stockholder of the Company. To do so, a stockholder should send the director candidate’s name, credentials, contact information and his or her consent to be considered as a candidate to the Company’s Corporate Secretary. The proposing stockholder should also include his or her contact information and a statement of his or her share ownership (i.e., how many shares of Common Stock the proposing stockholder owns and how long such shares have been held), as well as any other information required by the Company’s bylaws.

Capital Committee. The Capital Committee is currently comprised of four directors: Patricia Stensrud (Chair), E. Randall Chestnut, Zenon S. Nie and Donald Ratajczak. With the exception of Mr. Chestnut, none of the directors is a current or former employee of the Company or any of its subsidiaries, and such directors, in the opinion of the Board, are free from any relationship that would interfere with the exercise of their independent judgment in the discharge of the Capital Committee’s duties. The Capital Committee has adopted a formal, written charter, which has been approved by the full Board and which specifies the scope of the Capital Committee’s responsibilities and how it should carry them out. The complete text of the Capital Committee charter is available on the Company’s website at www.crowncrafts.com.

The Capital Committee is responsible for overseeing and making recommendations with respect to certain capital market transactions, including stock repurchases and dividend payments.

The following table provides a summary of the membership of the Board and its committees since the beginning of fiscal year 2021, together with information regarding the number of meetings held during fiscal year 2021.

|

Director Name

|

Independent

|

Audit Committee

|

Compensation Committee

|

Nominating Committee

|

Capital Committee

|

|

Randall Chestnut |

No |

✔ |

|||

|

Sidney Kirschner |

Yes |

✔ |

✔ |

✔ |

|

|

Zenon S. Nie |

Yes |

✔* |

✔* |

✔ |

|

|

Donald Ratajczak |

Yes |

✔* |

✔ |

✔ |

|

|

Patricia Stensrud |

Yes |

✔ |

✔ |

✔* |

|

|

Number of Meetings |

4(1) |

12 |

10 |

4 |

|

* Chair

(1) Executive sessions were held with the Company’s independent auditor at each of these meetings.

The Board met nine times during fiscal year 2021. Each director attended all of the meetings of the Board and committees of which he or she was a member during fiscal year 2021. All Board members attended the Company’s annual meeting of stockholders held in 2020, and all members of the Board have been requested to attend the Annual Meeting. Although the Company has no formal policy with respect to Board members’ attendance at the Company’s annual meeting of stockholders, it is customary for all Board members to attend.

Identifying and Evaluating Nominees

With respect to the nomination process, the Nominating and Governance Committee reviews the composition and size of the Board to ensure that it has the proper expertise and independence; determines the criteria for the selection of Board members and Board committee members; establishes criteria for qualifications as independent directors, consistent with applicable laws and listing standards; maintains a file of suitable candidates for consideration as nominees to the Board; reviews Board candidates recommended by stockholders in compliance with all director nomination procedures for stockholders; and recommends to the Board the slate of nominees of directors to be elected by the stockholders and any directors to be elected by the Board to fill vacancies.

The Nominating and Governance Committee will evaluate candidates for election to the Board based on their financial literacy, business acumen and experience, independence and willingness, ability and availability for service. This may include consideration of factors such as the following:

|

● |

Whether the potential nominee has leadership, strategic or policy-setting experience in a complex organization, including not only a corporate organization but also any governmental, educational or other non-profit organization; |

|

● |

Whether the potential nominee has experience and expertise that is relevant to the Company’s business, including any specialized business experience, technical expertise or industry expertise, and whether the potential nominee has knowledge regarding issues affecting the Company; |

|

● |

Whether the potential nominee is highly accomplished in his or her respective field; |

|

● |

Whether the potential nominee has high ethical character and a reputation for honesty, integrity and sound business judgment; |

|

● |

Whether the potential nominee is free of any conflict of interest or the appearance of any conflict of interest and whether he or she is willing and able to represent the interests of all stockholders; |

|

● |

Any factor affecting the ability or willingness of the potential nominee to devote sufficient time to the Board’s activities and to enhance his or her understanding of the Company’s business; and |

|

● |

How the potential nominee would contribute to diversity, with a view toward the needs of the Board as a whole. |

Additionally, with respect to an incumbent director whom the Nominating and Governance Committee is considering as a potential nominee for re-election, the Nominating and Governance Committee will review and consider the incumbent director’s service during his or her term, including the number of meetings attended, level of participation and overall contribution to the Company. The manner in which the Nominating and Governance Committee evaluates a potential nominee will not differ based on whether the potential nominee is recommended by a stockholder.

The Nominating and Governance Committee has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees, although the committee and the Board are committed to a diversified membership. When identifying and recommending director nominees, the members of the committee generally view diversity expansively to include, without limitation, concepts such as race, gender, national origin, differences of viewpoint and perspective, professional experience, education, skill and other qualities or attributes that together contribute to the functioning of the Board.

The Board believes that having a single leader serving as Chairman of the Board and Chief Executive Officer, together with an experienced and engaged Lead Director, is the most appropriate leadership structure for the Board at this time.

Combining the roles of Chairman of the Board and Chief Executive Officer makes clear that the person serving in these roles has primary responsibility for managing the Company’s business, subject to the oversight and review of the Board. Under this structure, E. Randall Chestnut, the current Chairman of the Board and Chief Executive Officer, chairs Board meetings, where the Board discusses strategic and business issues. The Board believes that this approach is preferable because the Chief Executive Officer is the individual with primary responsibility for implementing the Company’s strategy, directing the work of other officers and leading implementation of the Company’s strategic plans as approved by the Board. This structure creates a single leader who is directly accountable to the Board and, through the Board, to stockholders, and enables the Chief Executive Officer to act as the key link between the Board and other members of management. In addition, Mr. Chestnut personally brings to the combined role of Chairman of the Board and Chief Executive Officer a long history with the Company.

Because the Board also believes that strong, independent Board leadership is a critical aspect of effective corporate governance, the Board has established the position of Lead Director. The Lead Director, who must be independent, is elected by the independent directors. The Lead Director presides over executive sessions of the independent directors, consults with the Chairman of the Board, oversees the flow of information to the Board and acts as liaison between the non-employee directors and management. As the primary interface between the Chief Executive Officer and the Board, the Lead Director provides a valuable counterweight to the combined Chairman of the Board and Chief Executive Officer role. The Lead Director also serves as a focal point for the independent directors, thereby enhancing and clarifying the Board’s independence from management. Zenon S. Nie currently serves as the Lead Director.

As noted above, the Company’s business and affairs are managed under the direction of its Board. This includes the Board’s overseeing the type and amount of risk undertaken by the Company. In discharging its oversight responsibilities, the Board relies on a combination of the business experience of its members and the expertise and business experience of the Company’s officers and employees, as well as, from time to time, advice of various consultants and experts. An appropriate balancing of risks and potential rewards with the long-term goals of the Company is, and historically has been, implicit in the decisions and policies of the Board. Because risk oversight is so thoroughly made a part of all Board deliberations and discussions, no special provision has been made for that oversight in the Board’s leadership structure, except in connection with the role of the Audit Committee, which has responsibility for overseeing the Company’s risk management programs and policies.

The Audit Committee focuses on financial reporting risk, oversees the entire audit function and evaluates the effectiveness of internal and external audit efforts. It receives reports from management regularly regarding the Company’s assessment of risks and the adequacy and effectiveness of internal control systems. The Audit Committee reports regularly to the full Board and is required by its charter to discuss at least annually with management and the Company’s independent auditor the adequacy of the Company’s risk management programs and policies, including any recommendations the committee may have for improvements in those areas.

Compensation Committee Interlocks and Insider Participation

During the fiscal year 2021, Messrs. Nie and Kirschner and Ms. Stensrud served as members of the Compensation Committee. None of them is or has been an officer or employee of the Company.

Communication with the Board and its Committees

Any stockholder may communicate with the Board by directing correspondence to the Board, any of its committees or one or more of its individual members, in care of the Company’s Corporate Secretary, at Crown Crafts, Inc., P.O. Box 1028, Gonzales, Louisiana 70707.

The Company has a classified Board currently consisting of one Class I director (E. Randall Chestnut), two Class II directors (Sidney Kirschner and Zenon S. Nie) and two Class III directors (Donald Ratajczak and Patricia Stensrud). At each annual meeting of stockholders, directors are elected to the Board to serve until the third ensuing annual meeting of stockholders and until their successors are elected and qualified or until their earlier death, resignation or removal from office.

The Class I director currently serves until the Company’s annual meeting of stockholders to be held in 2022, and the Class II and Class III directors currently serve until the Company’s annual meetings of stockholders to be held in 2021 and 2023, respectively. Pursuant to the Company’s bylaws, the Board has fixed its membership at five directors.

At the Annual Meeting, two Class II directors will be elected to the Board to serve until the Company’s annual meeting of stockholders to be held in 2024 and until their successors are elected and qualified or until their earlier death, resignation or removal from office. The Board has nominated Sidney Kirschner and Zenon S. Nie for re-election to the Board as Class II nominees. Messrs. Kirschner and Nie have consented to serve and be named in this Proxy Statement and will serve as directors, if elected, for their term and until their successors shall be elected and shall qualify, except as otherwise provided in the Company’s bylaws.

If you properly grant your proxy and submit it to the Company in time to vote, the proxy holder will vote your shares “for” the election of Messrs. Kirschner and Nie unless you have specifically indicated by proper proxy that your shares should be withheld from voting for either or both of them. Proxies cannot be voted at the Annual Meeting for a greater number of persons than the number of nominees named.

The following persons are nominees for Class II directorships with a term ending in 2024:

|

Name |

Age |

Director Service |

|

Sidney Kirschner |

86 |

2001 – present |

|

Zenon S. Nie |

70 |

2001 – present |

Sidney Kirschner has served as Executive Vice President of Piedmont Healthcare and Chief Philanthropy Officer of the Piedmont Healthcare Foundation since 2010. Mr. Kirschner previously served as Head of School at the Alfred & Adele Davis Academy from 2007 to 2010 and as Chairman of the Board, President and Chief Executive Officer of Northside Hospital, Atlanta, Georgia, from 1992 to 2004. From 1987 to 1992, he served as Chairman of the Board, Chief Executive Officer and President of National Service Industries, Inc., formerly a Fortune 500 company listed on the New York Stock Exchange. Mr. Kirschner has served on the board of directors of numerous community organizations. He is a member of the board of directors of Superior Uniform Group, Inc. and Cleveland Group, Inc.

Zenon S. Nie has served since 2001 as Chairman of the Board, President and Chief Executive Officer of the CEO Advisory Board LLC, a management consulting firm he founded in 2000, and since 2001 has also been an operating partner in Tri-Artisan Partners, which merged with Morgan Joseph to form Morgan Joseph TriArtisan LLC in January 2011. From 1993 to 2000, he was Chairman of the Board, President, Chief Executive Officer and Chief Operating Officer of Simmons Company, a billion-dollar international manufacturer and distributor of mattresses. From 1991 to 1993, he was President of the Consumer Home Fashion division of the Bibb Company, which included the Juvenile Products textile division. Prior to that, he was President of Serta Incorporated and held other senior executive positions at both Serta and Sealy Incorporated over the previous 13 years. Mr. Nie has earned the CERT Certificate in Cybersecurity Oversight for directors from the Software Engineering Institute at Carnegie Mellon University and is a National Association of Corporate Directors (“NACD”) Board Leadership Fellow.

Recommendation of the Board of Directors

| The Board unanimously recommends a vote “FOR” each of the Class II nominees disclosed above. Proxies will be voted “FOR” the election of these nominees unless otherwise specified. |

The following persons are the Class I and Class III directors of the Company, with terms expiring as set forth below:

|

Director |

Age |

Director Service |

Director |

Expiration of Current Term |

|

E. Randall Chestnut |

73 |

1995 – present |

I |

2022 |

|

Dr. Donald Ratajczak |

78 |

2001 – present |

III |

2023 |

|

Patricia Stensrud |

73 |

2011 – present |

III |

2023 |

E. Randall Chestnut joined the Company in January 1995 as Vice President, Corporate Development. Since then, he has been an executive of the Company, and in July 2001, he was elected the Company’s President (serving until January 4, 2021), Chief Executive Officer and Chairman of the Board. Pursuant to Mr. Chestnut’s amended and restated employment and severance protection agreement with the Company, Mr. Chestnut will continue to serve as the Chairman of the Board so long as he is a member of the Board.

Dr. Donald Ratajczak recently retired as a consulting economist, having served in such role from 1983 until 2018 for various financial institutions/investment banks, most recently Raymond James. He served from 2000 to 2003 as the Chairman and Chief Executive Officer of Brainworks Ventures, Inc., an enterprise development company he founded in 2000. He is also Regent’s Professor Emeritus at the Robinson College of Business at Georgia State University. From 1997 to 2000, he was Regent’s Professor of Economics at Georgia State University, and from 1973 to 1997, he was a Professor or Associate Professor in that department. He is also the founder, and from 1973 to 2000 was the Director of the Economic Forecasting Center at Georgia State University. He was a director of Assurance America from 2003 until 2015, Citizens Bancshares from 2003 until 2014, and Ruby Tuesday from 1981 until 2012.

Patricia Stensrud has served since 2016 as a Managing Director with Avalon Securities LLC, a New York-based boutique investment bank where she provides financial and strategic business advisory services to lower- and middle-market companies with clients encompassing a mix of private and public companies as well as private equity funds in domestic and international markets. She is also the Founder and Managing Partner of Hudson River Partners, LLC, an advisory and real estate investment firm. Her C-suite operating background covers a range of industry sectors. From May 2011 through November 2015, Ms. Stensrud served as President of A&H Worldwide, a leading packaging company with global operations in the United States, China and the United Kingdom. Between December 2005 and December of 2010, through Hudson River Partners, her focus was on M&A activity within the fashion and accessories industry. From January 2005 until November 2005, she worked with Tommy Hilfiger USA where she served as President of the Women’s Sportswear Division prior to relocation of the company’s headquarters to Amsterdam. Prior to that she was Chief Executive Officer of Victoria + Co, a division of Jones Apparel Group in addition to having held leadership positions with Avon Products and IBM. Ms. Stensrud served as a member of the board of directors of Christopher & Banks Corporation from 2011 through June of 2016, and is Board Chair Emeritus for the Girl Scouts Council of Greater New York. She is a recognized NACD Board Leadership Fellow.

The directors believe that their combined business and professional experience and expertise make them a valuable resource to management and qualify them for service on the Board. Many of the Company’s current directors, including Messrs. Kirschner, Nie and Ratajczak, have served on the Board since the reorganization of Crown Crafts in 2001. Mr. Chestnut has been with the Company, including serving as a director, for 25 years. During their tenures, these directors and nominees have gained considerable institutional knowledge about the Company, its operations and its industry, which has made them effective directors. Continuity of service and this development of institutional knowledge help make the Board more efficient and effective at developing long-range plans than it would be if there were frequent turnover in Board membership.

As noted above, Mr. Chestnut is the Company’s longest-tenured director. His perspective with respect to the Company’s progress and past challenges as both a director and an officer of the Company is essential when the Board is evaluating issues and risks facing the Company. His knowledge and understanding of the industry and its key players, including suppliers and customers, make Mr. Chestnut an invaluable resource for the Board.

Mr. Kirschner brings to the Company a valuable understanding of its opportunities and the challenges it faces. During a successful and varied career, he has held top executive officer positions with a former Fortune 500 company and has served on the boards of other successful companies, including companies in the textile and manufacturing industries.

Mr. Nie is a key voice on the Board with respect to strategy and growth. During his varied career, he has gained valuable perspective on management matters, having served in top executive positions with other manufacturing companies.

Dr. Ratajczak is a leading economist who is regularly called on to provide advice and guidance with respect to financial and economic matters. His considerable expertise and experience in these areas combine with his understanding of the Company’s operations to make him a significant contributor to the Board.

Ms. Stensrud brings to the Company extensive experience in the consumer goods and apparel industries. Her experience provides the Company with added insight into the views of retailers and suppliers alike and enables Ms. Stensrud to offer a unique and valuable perspective to the Board.

Each non-employee director is paid an annual retainer of $40,000, with no additional Board meeting fees paid. The Lead Director is paid an additional $20,000 for his service in that position. Additional annual retainers are paid to committee chairs as follows: (i) Audit Committee Chair, $12,000; (ii) Compensation Committee Chair, $10,000; and (iii) Nominating and Governance Committee Chair and Capital Committee Chair, $4,500 each. Each non-employee director receives a cash fee of $1,000 for each committee meeting attended, and each non-employee director also received a restricted stock grant in August 2020 of 10,363 shares of Common Stock. Directors who are employees of the Company or its subsidiaries do not receive any compensation for their service as directors.

The following table sets forth information regarding compensation earned by or paid to the Company’s non-employee directors for fiscal year 2021.

|

Name |

Fees Earned or Paid |

Stock |

All Other Compensation |

Total |

|

Sidney Kirschner |

$69,500 |

$60,000 |

- |

$129,500 |

|

Zenon S. Nie |

$99,500 |

$60,000 |

- |

$159,500 |

|

Donald Ratajczak |

$70,000 |

$60,000 |

- |

$130,000 |

|

Patricia Stensrud |

$64,500 |

$60,000 |

- |

$124,500 |

|

(1) |

Includes fees earned in fiscal year 2021 but paid in fiscal years 2020 and 2021. |

|

(2) |

Stock awards consist of awards of unvested stock granted on August 12, 2020. The dollar amounts reported in the table above reflect the aggregate grant date fair value of these shares computed in accordance with FASB ASC Topic 718 using the closing price of Common Stock of $5.79 per share as reported on Nasdaq on the date of grant. These amounts may not correspond to the actual value that will be recognized by the directors. The shares vest in equal installments over a two-year period. |

Executive officers of the Company are elected or appointed by the Board and hold office until their successors are elected or until their earlier death, resignation or removal, subject to the terms of applicable employment agreements. See “ – Compensation Discussion and Analysis – Employment, Severance and Compensation Arrangements.” The executive officers of the Company are as follows:

|

Name |

Age |

Position With Company |

|

E. Randall Chestnut (1) |

73 |

Chairman of the Board and Chief Executive Officer |

|

Olivia W. Elliott (2) |

52 |

President and Chief Operating Officer |

|

Craig J. Demarest (3) |

55 |

Vice President and Chief Financial Officer |

|

Donna E. Sheridan (4) |

57 |

President and Chief Executive Officer, NoJo Baby & Kids, Inc. (“NoJo”) |

|

(1) |

Information about the business experience of Mr. Chestnut is set forth under “Proposal 1- Election of Directors - Continuing Directors.” |

|

(2) |

Ms. Elliott, a Certified Public Accountant, assumed the role of the Company’s President and Chief Operating Officer in January 2021, after serving as the Company’s Vice President and Chief Financial Officer since September 2008. She continued to serve as the Company’s Chief Financial Officer until February 2021. She joined the Company in November 2001 as Secretary and Treasurer. She began her career in public accounting in 1991 with Deloitte & Touche LLP, where she worked for more than three years, after which she worked for seven years in finance and treasury functions with two public companies. |

|

(3) |

Mr. Demarest joined Crown Crafts in February 2021 as its Chief Financial Officer. He previously served as the Chief Financial Officer of Carbo Ceramics Inc., a global technology company that provides products and services to the oil and gas, industrial and environmental markets, from September 2020 to February 2021. Prior to that, he served almost 15 years in various positions at Tidewater Inc., an NYSE listed company providing offshore marine support and transportation services to the global offshore energy industry. At Tidewater, he advanced to Vice President, Controller and Principal Accounting Officer, a position that he held from June 2008 to December 2018. He also spent almost 17 years with KPMG LLP, serving as an Audit Partner of the firm from 1999 to 2004. |

|

(4) |

Ms. Sheridan joined NoJo in January 2019. She was previously Senior Vice President at Lambs & Ivy for eight years. Prior to that, she served as General Manager for Disney Consumer Products over Soft Lines for North America and had previously held numerous other roles with the Walt Disney Company over a fourteen-year period, including brand management, merchandising and director roles. |

Compensation Discussion and Analysis

The Compensation Committee has overall responsibility for establishing, implementing and monitoring the Company’s compensation structure, policies and programs. The Compensation Committee oversees the design and implementation of strategic compensation programs for the Company’s executive officers and is responsible for assessing and approving the total compensation paid to the Company’s Chief Executive Officer and his compensation recommendations for other executive officers and for determining whether the compensation paid under the Company’s programs is fair, reasonable and competitive. The Compensation Committee Chair regularly reports to the Board on Compensation Committee actions and recommendations. The Compensation Committee has authority to retain (at the Company’s expense) outside counsel, compensation consultants and other advisors to assist as needed.

The individuals who served as the Company’s Chief Executive and Chief Financial Officers during fiscal year 2021, as well as the other individuals included in the “- Summary Compensation Table” below, are referred to individually, as a “named executive officer,” and collectively, as the “named executive officers.” With respect to the named executive officers, this Compensation Discussion and Analysis identifies the Company’s current compensation philosophy and objectives and describes the various methodologies, policies and practices for establishing and administering the compensation programs of the named executive officers.

Compensation Philosophy and Objectives

The Compensation Committee believes that the most effective executive compensation programs are those that align the interests of the Company’s executive officers with those of its stockholders. The Compensation Committee further believes that a properly structured compensation program will attract and retain talented individuals and motivate them to drive stockholder value and achieve specific short- and long-term strategic objectives and that a significant percentage of executive pay should be based on the principle of pay-for-performance. However, the Compensation Committee also recognizes that the Company must maintain its ability to attract highly talented executives. For this reason, an important objective of the Compensation Committee is to ensure that the Company’s compensation program is competitive with its peer-group companies (the “compensation peer group”).

The Company’s executive compensation program is designed to provide:

|

● |

levels of base compensation that are competitive with comparable companies; |

|

● |

annual incentive compensation that varies in a manner consistent with the achievement of individual performance objectives and financial results of the Company; |

|

● |

long-term incentive compensation that focuses executive efforts on building stockholder value through meeting longer-term financial and strategic goals; and |

|

● |

executive benefits that are meaningful and competitive with comparable companies. |

In designing and administering the Company’s executive compensation program, the Compensation Committee attempts to strike an appropriate balance among these various elements. The Compensation Committee considers the pay practices of the compensation peer group to determine the appropriate pay mix and compensation levels. With respect to performance-based pay, the Compensation Committee believes that executive compensation should be closely tied to the financial and operational performance of the Company, as well as to the individual performance and responsibility level of the named executive officers. The Compensation Committee also believes that the Company’s executive compensation program should include a significant equity-based component because it best aligns the executives’ interests with those of the Company’s stockholders. For purposes of retention, the Compensation Committee believes that the equity-based component should have meaningful conditions to encourage valued employees to remain in the employ of the Company. Finally, the Compensation Committee also considers other forms of executive pay as a means to attract, retain and motivate highly qualified executives.

Methodology for Establishing Compensation

The Compensation Committee is comprised of three independent directors, all of whom satisfy the Nasdaq listing requirements and relevant SEC regulations. There are no interlocking relationships between any member of the Compensation Committee and any of our executive officers. None of the Compensation Committee members is an officer, employee or former officer or employee of the Company.

The Compensation Committee is responsible for all compensation decisions for the Chief Executive Officer and other named executive officers. The Chief Executive Officer annually reviews the performance of the other named executive officers, including consideration of market pay practices of the compensation peer group in conjunction with both Company and individual performance. The conclusions and recommendations of the Chief Executive Officer are presented to the Compensation Committee for approval. The Compensation Committee has absolute discretion as to whether it approves the recommendations of the Chief Executive Officer or makes adjustments, as it deems appropriate.

The Elements of Compensation

Total direct compensation includes cash, in the form of base salary and annual incentives, and long-term equity incentives. The Compensation Committee evaluates the mix between these three elements based on the pay practices of comparable companies.

The companies included in the compensation peer group are selected primarily on the basis of their comparability to the Company based on size, as measured through annual revenue, market capitalization and other financial measures. Although the Compensation Committee also considers and reviews information from proxy statements and other relevant survey data, it particularly focuses on the practices of the compensation peer group in considering compensation levels for the Company’s Chief Executive Officer and the other named executive officers. The Compensation Committee considers the opinions and recommendations of the Chief Executive Officer and various outside advisers and strives to be fully informed in its determination of the appropriate compensation mix and award levels for the named executive officers. All compensation decisions take into consideration the Compensation Committee’s guiding principles of fairness to employees, retention of talented executives and fostering improved Company performance, which it believes will ultimately benefit the Company’s stockholders. With respect to the named executive officers, the following table and text describe in greater detail the objectives and policies behind the various elements of the compensation mix.

|

Component |

Type |

Objectives |

||

|

Base Salary |

|

Fixed |

|

• Attract and retain executives • Compensate executive for level of responsibility and experience |

|

Annual Incentive Bonus |

|

Variable |

|

• Reward meaningful contributions to the Company’s profitability • Reward achievement of the Company’s annual financial and operational goals • Promote accountability and strategic decision-making |

|

Long-Term Incentive Awards |

|

Variable |

|

• Align management and stockholder goals by linking management compensation to stock price over extended period • Encourage long-term, strategic decision-making • Reward achievement of long-term company performance goals • Promote accountability • Retain key executives |

|

Broad-Based Benefits Programs |

|

Fixed |

|

• Foster the health and well‑being of executives • Attract and retain executives • Reward employee loyalty and long-term service |

Base Salary. It is the Company’s philosophy that employees be paid a base salary that is competitive with the salaries paid by comparable organizations based on each employee’s experience, performance and geographic location. Generally, the Company has chosen to position cash compensation at close to market median levels in order to remain competitive in attracting and retaining executive talent. The allocation of total cash between base salary and incentive bonus awards is based on a variety of factors. The Compensation Committee considers a combination of the executive’s performance, the performance of the Company and the individual business or corporate function for which the executive is responsible, the nature and importance of the position and role within the Company, the scope of the executive’s responsibility and the current compensation package in place for the executive, including the executive’s current annual salary and potential bonus awards under the Company’s short-term incentive plan.

The Compensation Committee generally evaluates executive salaries annually. An analysis of the Company’s executive compensation indicated that base salaries for the named executive officers were generally positioned at the market median. During fiscal year 2021, based in part on information provided previously by an independent compensation consultant, as well as the Compensation Committee’s own assessment of the information and factors described above, the Compensation Committee determined to increase the base salary of Ms. Elliott and Ms. Sheridan incrementally to maintain market median levels.

Annual Incentive Bonus. The Company intends to continue its strategy of compensating the named executive officers through programs that emphasize performance-based incentive compensation. The Company’s short-term incentive compensation program is designed to recognize and reward executive officers and other employees who contribute meaningfully to the Company’s profitability and increase in stockholder value.

In general, the funding of the annual incentive bonus pool is dependent upon earnings before interest, taxes, depreciation and amortization (after deducting incentive compensation) of the Company and its subsidiaries. If the plan is fully funded, each named executive officer has the ability to receive the target bonus payout. The percentage of the target bonus actually paid to each named executive officer depends on the goal attainment levels. The threshold level of performance for funding the bonus pool is 90% of target, at which point the annual bonus pool is 5% funded.

For fiscal year 2021, the Company and two of its wholly-owned subsidiaries, NoJo and Carousel Designs, LLC, achieved the maximum level of the performance target. Sassy Baby, Inc., also a wholly-owned subsidiary of the Company, achieved greater than the minimum, but less than the maximum level of the performance target. Accordingly, the bonus pool was partially funded. Bonus amounts will be paid in the second quarter of fiscal year 2022, but were expensed in fiscal year 2021, the fiscal year in which the bonuses were earned and to which the payments relate.

Long-Term Incentive Awards. Long-term incentive awards are the third component of the Company’s total compensation package. The Compensation Committee believes that equity-based compensation ensures that the Company’s officers have a continuing stake in the long-term success of the Company. Accordingly, the Company’s officers and certain other employees may participate in the 2014 Omnibus Equity Compensation Plan (the “2014 Plan”) which provides for grants of equity incentive awards, including stock options, stock units, stock awards, stock appreciation rights and other stock-based awards. Awards may be granted under the 2014 Plan from time to time until August 11, 2024, unless the 2014 Plan is terminated or replaced prior to that date. The Compensation Committee approves all awards under the 2014 Plan and acts as the administrator of the 2014 Plan. At the Annual Meeting, the Company is asking its stockholders to approve the 2021 Plan to replace the 2014 Plan. See “Proposal 4 – Approval of the Crown Crafts, Inc. 2021 Incentive Plan.”

Award levels under the 2014 Plan are determined based on the compensation practices of the compensation peer group. In general, long-term incentive awards are targeted at the median of the compensation peer group with appropriate adjustments for individual and Company performance, although past awards have generally been below market levels. Stock options granted under the 2014 Plan, as well as under the Company’s prior equity compensation plans, vest and become exercisable in equal installments over a two-year period from the grant date, have a ten-year term and have an exercise price equal to the fair market value of Common Stock on the date of grant, and prior restricted stock awards have been subject to cliff vesting on the second, fourth or fifth anniversary of the date of grant. In the case of restricted stock, the shares are held by the Company’s transfer agent in escrow until restrictions lapse and the participant pays taxes on the value of the shares. Participants are entitled to any dividends payable on their restricted stock and to vote their shares. Restricted stock cannot be sold or transferred until the shares vest. Should a named executive officer leave the Company prior to the completion of the applicable vesting schedule, the unvested portion of the grant is forfeited.

Historically, the determination of whether equity compensation awards will be granted is made promptly following the preparation of the prior year’s audited financial statements because the awards are made (or not) based upon the Compensation Committee’s assessment of the Company’s overall performance for such period, as well as the Compensation Committee’s assessment of the individual’s overall performance over the same time. This determination is generally made considering the totality of the circumstances and not necessarily on the basis of one or more specified performance metrics.

Broad-Based Benefits Programs. The named executive officers are entitled to participate in the benefits programs that are available to all full-time employees. These benefits include health, dental, vision, disability and life insurance, paid vacation and Company contributions to a 401(k) profit-sharing retirement plan. The Company’s 401(k) plan provides for matching contributions by the Company in an amount equal to 100% of the first 2% of employee compensation deferred, plus 50% of the next 3% of employee compensation deferred. All employees age 18 and older are eligible to participate in the plan after two months of service.

Evaluation of Chief Executive Officer Compensation and Executive Performance

Compensation of Chief Executive Officer. The Compensation Committee meets with the other independent directors each year in an executive session to evaluate the performance of the Company’s Chief Executive Officer. The Compensation Committee does not confer with the Chief Executive Officer or any other members of management when setting the Chief Executive Officer’s base salary. The Compensation Committee does not rely solely on predetermined formulas or a limited set of criteria when it evaluates the performance of the Chief Executive Officer and the other named executive officers.

Compensation of Other Named Executive Officers. The Chief Executive Officer met with the Compensation Committee to review his compensation recommendations for the other named executive officers. He described the findings of his performance evaluation of all such persons and provided the basis of his recommendations with the Compensation Committee, including the scope of each person’s duties, oversight responsibilities and individual objectives and goals against results achieved. In its analysis of the other named executive officers, the Compensation Committee applied the same rationale to this group as it applied when considering the Chief Executive Officer’s base salary. The Compensation Committee also considered the pay practices of the compensation peer group and information previously provided to the Company by an independent compensation consultant.

Administrative Policies and Practices. To evaluate and administer the compensation programs of the Chief Executive Officer and other named executive officers, the Compensation Committee meets periodically each year in conjunction with regularly scheduled Board meetings. The Compensation Committee also holds special meetings and meets telephonically to discuss extraordinary items.

Employment, Severance and Compensation Arrangements

The Company has entered into an amended and restated employment and severance protection agreement with Mr. Chestnut and employment agreements with each of Ms. Elliott and Mr. Demarest. A summary of the terms of these agreements is set forth below.

E. Randall Chestnut. The Company entered into an amended and restated employment and severance protection agreement with Mr. Chestnut effective as of December 16, 2020, which amends and supersedes in their entirety the employment agreement, dated July 23, 2001, and the amended and restated severance protection agreement, dated April 20, 2004, each as subsequently amended, between the Company and Mr. Chestnut. Consequently, Mr. Chestnut now is entitled to receive only the compensation provided under the amended and restated employment and severance protection agreement and is no longer entitled to receive any compensation under the original agreements.

The term of Mr. Chestnut’s amended and restated employment and severance protection agreement ends April 2, 2023. Pursuant to the agreement, the Company agrees to continue to employ Mr. Chestnut as President until January 4, 2021 and as Chief Executive Officer until such time as the Board appoints a new Chief Executive Officer. In such event, Mr. Chestnut thereafter will continue to be employed by the Company and provide services reasonably necessary to support the new Chief Executive Officer. During the term, Mr. Chestnut will also continue to serve as the Chairman of the Board so long as he is a member of the Board.

Under Mr. Chestnut’s agreement, he: (i) received or will receive an annual salary equal to $463,500 through March 28, 2021, $231,750 from March 29, 2021 through April 3, 2022, and $154,484.66 from April 4, 2022 through April 2, 2023; and (ii) is eligible to receive a cash bonus with respect to fiscal year 2021 (consistent with past bonuses paid by the Company to him), but not with respect to any subsequent fiscal year. During the term of the agreement, so long as Mr. Chestnut serves as a member of the Board, he will also be entitled to receive an annual grant of shares of Common Stock on the same terms as the annual grant of shares made to non-employee members of the Board. Additionally, the agreement provides that Mr. Chestnut is entitled to participate in any medical, dental, hospitalization, disability, accident, life insurance and 401(k) plans or arrangements of the Company and to payment of reasonable moving expenses up to $30,000.

Pursuant to Mr. Chestnut’s agreement: (i) the Company purchased from Mr. Chestnut, on December 16, 2020, 250,000 shares of Common Stock owned by him for an aggregate purchase price of $1,885,875.00, or $7.5435 per share (which represents the trailing 10-trading day volume weighted average closing price of the Common Stock ending, and including, December 16, 2020); and (ii) the Company transferred to Mr. Chestnut title to the 2016 Ford F-150 used by him in connection with his employment. Additionally, pursuant to the agreement, the Company paid to Mr. Chestnut all accrued but unpaid vacation and other paid time off earned under the Company’s vacation and paid time off policies through March 28, 2021.